This year, the global LED display market size remained relatively stable. According to some media statistics, the overall market size is expected to reach 48.5 billion, basically unchanged from 48.2 billion in 2024. Looking at the application scenarios of LED displays, the overall market size of LED cinema screens exceeded 100 million, and LED all-in-one machines saw a significant increase in shipments this year, reaching a relatively ideal number. The virtual production market remained relatively stable. In the coming year, 2026, industry analysis suggests that the LED display industry will experience technological breakthroughs and market restructuring. Mini/Micro LED core technologies will develop rapidly, more scenario-based applications will deepen, and industry consolidation will accelerate, bringing with it more development opportunities. Today, let's review the current status and development trends of each link in the entire LED display industry supply chain, and explore the opportunities that the three major trends in the LED display industry – high definition, intelligence, and scenario-based applications – will bring in the new year.

Many people may not have a deep understanding of the LED display industry supply chain. Let's briefly discuss it today for your reference. The raw materials needed for LED displays are categorized as the upstream of the supply chain. This mainly includes PCBs, LED chips, LED substrates, glass substrates, color filters, polarizers, and liquid crystal materials. The midstream of the LED display supply chain mainly focuses on the LED display manufacturing process, including LED packaging (such as SMD and COB) and module production, ultimately assembling into finished display products. Many familiar manufacturers are key players in this segment. The downstream of the LED display industry supply chain is mainly concentrated in application markets, including live broadcasting, film and television applications, VR/AR, security monitoring, smart wearables, data centers, consumer electronics, large displays, and automotive displays.

LED Chips, LED Beads, and PCBs:

The LED display chip market is mainly dominated by companies such as Sanan Optoelectronics, Epistar, Nichia, and HC Semitek. The future technological trend is mainly driven by Mini/Micro LED technology, which promotes chip miniaturization and improves display resolution.

The main function of the driver IC is to determine the refresh rate, grayscale level, and energy efficiency of the display. The main companies in the driver IC sector include: Macroblock (MBI), Texas Instruments (TI), Analogix, MagnaChip, Raydium Semiconductor, and Samsung.

In the PCB sector, my country's PCB industry is mainly concentrated in the low-to-medium-end manufacturing field, with fewer companies in the high-performance manufacturing field. Major companies include Zhen Ding Technology, Dongshan Precision Manufacturing, Jian Ding Technology, and Shennan Circuit.

Silicon carbide (SiC) substrate materials, a type of substrate material, have high thermal conductivity, high critical breakdown field strength, and high electron saturation drift velocity, effectively overcoming the physical limitations of traditional silicon-based semiconductor devices and materials. This allows for the development of a new generation of semiconductor devices more suitable for high voltage, high temperature, high power, and high frequency conditions. Currently, the main products produced by companies in the industry are concentrated in 4-inch and 6-inch sizes, with 8-inch products in the R&D stage. Domestic SiC substrate companies include: Tianyue Advanced, Tianke Heda, Dongni Electronics, Tongguang Crystal, Guohong Zhongneng, and Chaoxin Semiconductor.

Sapphire substrate material is a material used for LED chip substrates. Sapphire has excellent stability and can be used in high-temperature growth processes, and its demand is constantly increasing. Major sapphire substrate material companies include Zhongtu Technology, Jing'an Optoelectronics, and Bolante Semiconductor.

Glass substrates have high technological barriers, and the industry is mainly monopolized by American and Japanese companies. To fill the domestic gap, Chinese companies are continuously increasing their R&D efforts in glass substrates.

In the polarizer sector, my country is a major producer and consumer of polarizers, with huge market demand. Major suppliers include: Sumitomo Chemical and Sugino Optoelectronics.

The midstream segment mainly includes LED packaging (such as SMD and COB) and module production, which are ultimately assembled into finished display screens. LED screens are an important carrier of LED display technology. In recent years, with the improvement of LED display manufacturing technology, the resolution of traditional LED displays has been significantly improved. With the development of industry technology and cost reduction, small-pitch LED displays are becoming more and more widely used. With advancements in packaging and other technologies, MicroLED is highly anticipated and presents significant business opportunities in the future ultra-high-definition display era, which will demand higher specifications in terms of image quality and resolution.

From the perspective of mainstream packaging technologies, LED screens mainly include: SMD (Surface Mount Device), COB (Chip-on-Board), GOB (Glue-on-Board), etc. Major manufacturers of LED rental screens include: Roleheller, Unilumin, Ledman, etc., all of which demonstrate strong capabilities and foresight in market layout and technological innovation. Some of these companies have already established complete production lines for LED screen epitaxy and chips, packaging, lighting, display screens, and injection molding, creating a relatively complete LED display screen industry chain and exhibiting the characteristics of an LED video wall screen industry cluster. The future development of these forward-looking companies is undoubtedly immeasurable.

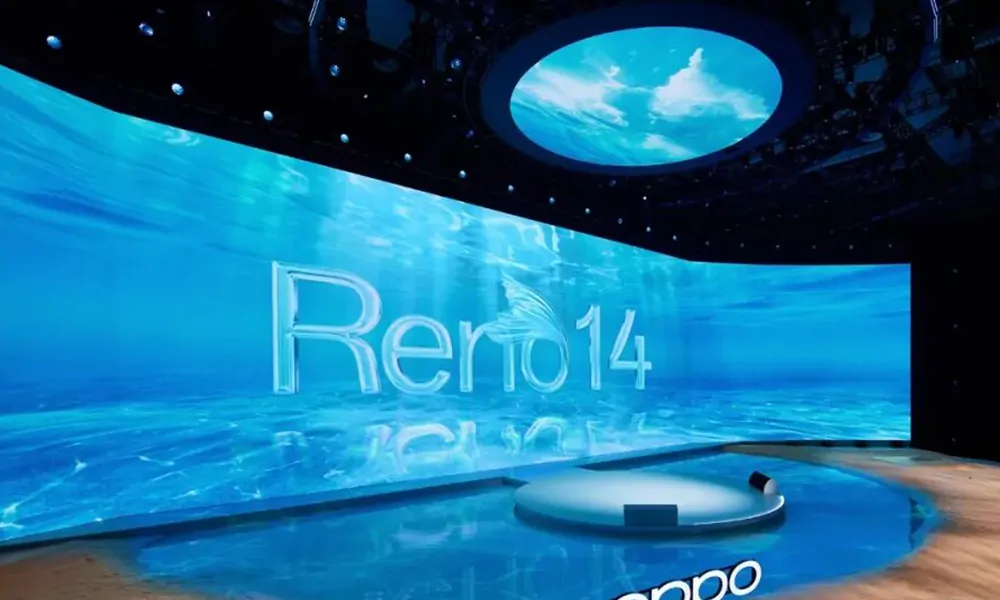

The downstream application market distribution of the LED display industry is concentrated in multiple fields. Key application scenarios include LED video wall screens for live e-commerce, LED film screens for virtual production, and educational training laboratories in universities. Policy support for AI and XR, as well as applications in security monitoring, smart wearables, data centers, consumer electronics, large displays, and automotive displays, are driving growth. Large-scale events, smart city construction, and smart transportation have also increased demand for LED display modules.

The LED panel industry shows trends of increased market concentration, rational purchasing behavior, and price transparency. Companies are shifting from single-product supply to overall scene solutions, focusing on system integration and user experience. COB technology is gradually becoming mainstream, while Micro MIP technology has moved to small-scale commercialization but faces hurdles before large-scale application.

Future opportunities for the LED display industry include accelerated penetration of Mini/Micro LED technology, deepening of scenario-based applications, and accelerated industry consolidation. Technological breakthroughs in Mini LED backlighting, Micro LED direct display, and MIP packaging technology will bring business opportunities, with Mini LED backlighting rapidly penetrating high-end TVs, gaming monitors, and automotive displays, and Micro LED direct display showing advantages in command centers, XR virtual production, and stage performances. New application scenarios emerging with technological development include the upgrade of e-commerce live streaming backdrops to large LED screens, the use of LED displays as information interaction hubs in smart city construction, and the increasing application of LED rental displays in virtual production and creative displays in film and television production.

While the industry may face some pressure in the coming year due to the overall economic environment, the long-term growth momentum remains strong. By focusing on core strengths, we hope that everyone can achieve better development.